Australian banks are some of the most profitable in the world. Over the last four years the five biggest banks have made $173 billion in pre-tax profits. The biggest banks get special protection from the government because they are seen as ‘too big to fail’, which amounts to a huge implicit subsidy.

Banks have made massive profits ripping off ordinary people. A study by the University of Melbourne found that bank ‘misconduct’ had cost Australians over $201 billion over the last five years. Based on South Australia’s share of the economy that means South Australians have been ripped off to the tune of $11 billion. In other words, the big banks have ripped $11 billion out of the South Australian economy and given nothing back. It’s time for that to change.

The Greens will:

| ▲ |

Impose a state-based Big Bank Levy, similar to the one proposed by Labor in 2017, of 0.05% of total liabilities per quarter on the five biggest banks operating in South Australia |

| ▲ |

Raise over $1.3 billion over four years, or $340 million every year |

| ▲ |

Prohibit banks by law from passing on the cost of the levy directly to customers |

How much will it raise?

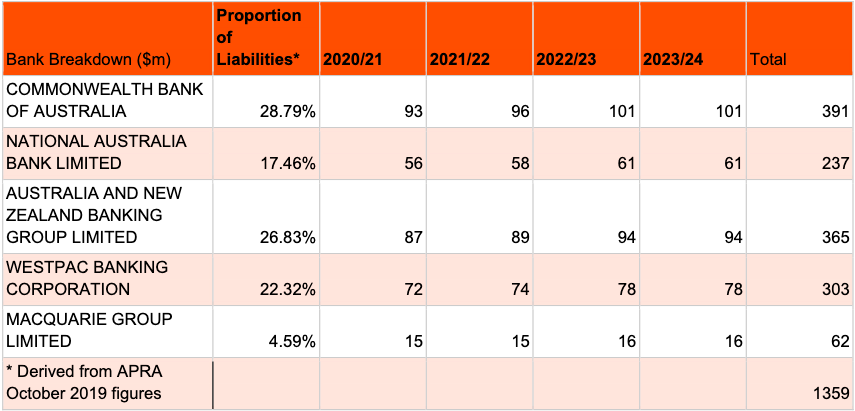

The levy rate will be set at 0.05% per quarter (or 0.2% per year) and apply to South Australia’s share of a bank’s total liabilities subject to the Commonwealth’s Major Bank levy (Commonwealth Bank, Westpac, ANZ, NAB and Macquarie). The South Australian share of a bank’s total liabilities will be calculated using South Australia’s Gross State Product as a share of national GDP, which is currently 5.5%.

The bank levy will raise $1.3 billion over four years, or $340 million each year on average. We will take $1.3 billion from the inflated profit margins of dodgy, greedy banks to invest in crucial public infrastructure, schools, hospitals and publicly owned renewable energy.

‘Too Big To Fail’ is an Implicit Subsidy

The biggest banks benefit from an ‘implicit guarantee’ which is an effective subsidy. This is because, like big banks around the world, they are deemed ‘too big to fail’. That means banks and investors can take big risks and even commit criminal offences while still paying very low costs for borrowing because everyone assumes the government will always bail them out in a crisis. They take the profits, but the Australian people carry the risks and the costs of a bailout.

A Fair Rate

The rate of the South Australian Greens’ Big Bank Levy is based on the IMF’s finding that ‘Systemically Important Banks’ receive an ‘implicit subsidy’ of at least 20 basis points (0.2%) per year as a result of the special protection they receive from the government.3 The Reserve Bank of Australia has found that the large Australian banks receive an effective subsidy of between 20 - 40 basis points (0.2% -0.4%).

A study conducted by modelling firm Macroeconomics and commissioned by the Customer Owned Banking Association found that the implicit subsidy for the big banks was between 22 and 34 basis points, amounting to up to $4.5 billion in 2014, or just under $5 billion in 2020 dollars.5

In this context the proposed rate of 0.05% per quarter or 0.2% per year is a perfectly fair recuperation of the benefits which the big banks receive from public protection.

What are bank liabilities?

The Big Bank Levy will be calculated based on a bank’s total liabilities, which is exactly the same as the tax base for the Federal government’s Major Bank Levy. Liabilities are banks’ main source of funding and include deposits from customers, loans from the Reserve Bank, trading liabilities and other loans taken by the bank.

How does this work with the Federal Bank Levy?

The Federal Government’s Major Bank Levy is set at 0.015% per quarter of total liabilities minus deductions and applies to all banks with total liabilities above $100 billion. It is expected to raise $1.6 billion this financial year, which is below even the most conservative estimates with regard to subsidies the big banks receive. The South Australian State Bank Levy would be applied on top of the Major Bank Levy and charged at the same time. It is applied to the exact same set of bank liabilities and institutions. However, the South Australian Big Bank Levy only applies to South Australia’s share of total bank liabilities based on our GSP.

How much will each bank pay?

The below estimate is based on the proportions of liabilities held by each of the five banks, according to figures from the Australian Prudential Regulation Authority (APRA). As an example, the $291 million the Commonwealth Bank would pay in 2019/20 would represent about 0.7% of its total yearly revenue.