Vacancy levy on empty homes, shops and blocks of land: Housing before profit

Rents and house prices are still rising, and thousands of Brisbanites can’t find secure, affordable housing.

Meanwhile, business owners are struggling to afford high commercial rents, which also contributes to higher costs for goods and services.

But across our city, there are tens of thousands of homes and shops sitting empty long-term, and hundreds of thousands of square metres of vacant land.

Major party politicians and property industry lobbyists claim that real estate is so expensive because there are ‘too many restrictions’ on private-sector supply. Meanwhile, the property industry is wasting valuable homes, shops and blocks of land by leaving them sitting vacant.

That’s because a small, elite class of the wealthiest investors - including multinational investment funds, property investment trusts, bigger developers, and mega-rich property speculators - are engaging in a widespread practice called ‘land banking’ - holding onto real estate without actually using it, while waiting for property values to rise.

But the Greens believe that investment properties shouldn’t be left sitting empty while people are sleeping on the street.

That’s why we want to introduce a vacancy levy on investment properties - including homes, apartments, commercial buildings and blocks of land - that are left empty for more than 6 months without a good reason.

If investors leave sites vacant, we want to charge them tens of thousands of dollars per year to encourage them to either rent their sites out, redevelop them as housing, or sell them to someone who will actually use them. We would set a vacancy levy at 2000% of the standard council rates for a property.

A vacancy levy would discourage properties being left empty long-term, which would:

- release thousands of existing homes onto the rental and sales markets

- catalyse the construction of more new housing on vacant land

- put downward pressure on residential and commercial rents

- put downward pressure on land values and the cost of buying housing

How widespread is this problem?

Under-utilised land

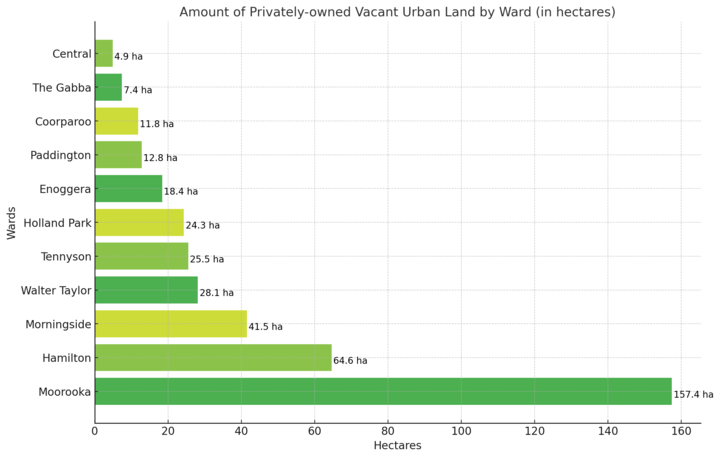

Data published by Brisbane City Council in May 2023 revealed that there are 2349 hectares or 23.5 km2 of privately owned ‘vacant urban land’ in Brisbane.1 More than 1200 of the 6,806 of the properties classified as privately owned ‘vacant urban land’ across the city have an area greater than 1000m2. Some are as large as a hectare - 10 000m2.

Shockingly, there 396 hectares (or 3.9 km2) of privately owned ‘vacant urban land’ in the inner-city and middle suburbs, where new homes are needed most.2

The council definition of ‘vacant urban land’ does not include rural-zoned land on the suburban outskirts, nor does it include undeveloped blocks that have no buildings on them but have an ongoing council-approved usage as holding yards for industrial activities (e.g. storing machinery or building materials). The figures above do not include land owned by the Federal or State governments, or by Brisbane City Council.

Much of the vacant urban land is in Brisbane’s outer suburbs, but there are also large blocks of privately-owned developable land in the inner-city, with 7.37 hectares of vacant land in the Gabba Ward, 4.92 hectares of vacant land in Central Ward, 11.81 hectares in Coorparoo Ward, 28.15 hectares in Walter Taylor Ward and 12.84 hectares in Paddington Ward.

Hamilton Ward, in the city’s inner-northeast, has a particularly notable phenomenon of land-banking, with 64.64 hectares of vacant land.

|

Brisbane City Council (inner-city and middle-suburban wards) |

Privately-owned ‘vacant urban land’ (in hectares) |

|

Central |

4.9 |

|

Coorparoo |

11.8 |

|

Enoggera |

18.4 |

|

Hamilton |

64.6 |

|

Holland Park |

24.3 |

|

Moorooka |

157.4 |

|

Morningside |

41.5 |

|

Paddington |

12.8 |

|

Tennyson |

25.5 |

|

The Gabba |

7.4 |

|

Walter Taylor |

28.1 |

|

Total (inner and middle suburbs only) |

396.8 ha |

This graph shows how much vacant land there is in each of Brisbane's inner-ring wards.

In some areas, developers who have already subdivided multiple blocks of land are deliberately delaying their release to market, listing only one block at a time in order to keep prices high. In other neighbourhoods, vacant blocks have sat abandoned for years, while the owners quietly lobby the council to rezone the sites for higher-density development, so they can sell off the blocks for a massive profit without actually building anything.

Empty dwellings

There are approximately 520 000 privately-owned residential dwellings in the Brisbane local government area.

We estimate that 10,000 to 15,000 of those dwellings are sitting empty in Brisbane for more than 6 months, without being advertised for rent or sale (or undergoing active renovation work).

The August 2021 Census (conducted during a period of COVID-related travel restrictions, when far fewer people than normal were away from their primary home for work or leisure), identified that in the Brisbane City Council local government area, 36 586 privately-owned residential houses and units (7.3% of all private dwellings) were unoccupied on Census night. Even when subtracting the several thousand homes that were only temporarily empty while listed for sale or rent, and those under renovation, that’s still tens of thousands of homes that may be empty for a prolonged period.

Even the most conservative estimates, which measure electricity usage or water usage (and so can’t account for apartments in blocks that aren’t individually metered), suggest that 5747 homes in Brisbane homes in the Brisbane local government area have been sitting empty long-term. This figure does not include the thousands of ‘second homes’ across our city where rich investors buy houses or apartments in dozens of different cities around the world that they only visit for a couple of weeks each year.

Vacant shops and offices

In addition to the thousands of hectares of vacant land and thousands of empty homes, there are also thousands of shops, office blocks, warehouses and abandoned factories across Brisbane that have remained empty for years. Many of these commercial properties are advertised ‘For Lease,’ but the rents that the owners are demanding are prohibitively expensive, and not commercially viable for small business owners or non-profit organisations.

In almost every shopping mall and commercial precinct across the city, you can find shops and restaurants whose owners would rather keep empty than rent them out cheaply.

Brisbane’s overall CBD vacancy rate is approximately 19.5%, and commercial vacancy levels are likely higher in many suburban areas. That means at least 10% of useable commercial building space across the entire Brisbane local government area is sitting vacant. These buildings could instead be used by small businesses, startups and even non-profit organisations that need premises, or alternatively, in some cases, they could be converted from commercial uses into housing.

Too many buildings sitting empty in a shopping centre or along a local high street can have negative flow-on impacts for the remaining businesses, making a precinct feel deserted and depressing. Landlords’ willingness to leave shops empty rather than renting them out cheaply puts upward pressure on rents and property prices, and also means prime sites that could otherwise be used for housing or community facilities are locked away.

How can we address this?

The Greens propose to introduce a vacancy levy that will charge investors tens of thousands of dollars per year if they leave a property vacant without good reason for more than six months.

The vacancy levy would be 20x the standard rates bill for the property, and would be charged quarterly. Any revenue raised through this initiative would be put towards the creation and maintenance of domestic violence crisis accommodation.

This levy only applies to investment properties, not properties that have been classified by the council as owner-occupied. So it would not apply to someone’s primary residence if they leave it empty for more than 6 months while travelling, or while receiving healthcare, or if they have recently been admitted to a nursing home.

Strict financial penalties would also be imposed against investors who are caught concealing the fact that their property is empty in order to avoid the vacancy levy.

What are valid reasons for an investment property being empty that would exempt it from the higher rates?

- If the ownership of the property changed in the past six months

- If the owner of the property passed away in the past six months

- If a new dwelling is currently being constructed on the property

- If the property is genuinely undergoing renovation, redevelopment or major repairs and construction work is ongoing

- If the property was impacted by a disaster in the past 18 months that rendered it uninhabitable

- the land is used as wildlife habitat and has been recognised by the council as having ecological conservation value (e.g. is part of a Land for Wildlife program)

This vacancy levy would mean that the owner of an inner-city investment property that usually attracts a rates bill of $2000 per year would face a bill of $40 000 per year if they left the unit empty for more than 6 months.

The likely effects of a vacancy levy

By creating a significant financial disincentive for leaving land unutilised, we anticipate that this initiative would mean:

- Several thousand existing residential homes would be brought up to a liveable standard and made available as private rentals, putting downward pressure on rents

- Commercial landlords with properties available for lease would also lower their asking rents in order to find tenants, making it easier for local businesses to afford to lease out premises

- Several thousand existing residential homes and several thousand shops, offices and other commercial building would be advertised for sale, putting downward pressure on property prices and ensuring these sites are transferred to owners who will actually use them

- Developers and land speculators would immediately advertise and sell hundreds of blocks of subdivided developable land which they were withholding from the market, putting downward pressure on land values

- Developers who had been holding off on development while waiting for land to be rezoned at some point in the future would bring forward construction timelines and start building new housing based on existing zoning rules

- Some empty commercial buildings would be renovated and redeveloped into residential units

- Some empty blocks of land would be repurposed for growing food, for sport and recreation, or for use as caravan parks/portable dwelling eco-villages

The net effect would be to trigger a rapid increase in the rate of construction of new dwellings that comply strictly with existing planning codes and rules, and for property prices and rents to fall.

What if someone lives and works part-time in Brisbane and part-time somewhere else?

As explained above, this vacancy levy does not apply to homes classed as ‘owner-occupier’ - only to investment properties. Ordinarily, if a person has one residential home in Brisbane city and, for example, another home in a regional town, the Brisbane dwelling will still be classed as an owner-occupier dwelling if it’s the only dwelling they own in the Brisbane City Council area.

In situations where someone leaves a Brisbane dwelling that is not classed as ‘owner-occupier’ empty for more than 6 months of the year, but still needs to live in it for a few months of the year, they could still avoid the vacancy levy simply by renting it out for a few months, or freely offering it for house-sitting, rather than leaving it empty.

What if there are multiple dwellings on my property, and some of them are empty?

You would not be charged a vacancy levy if all dwellings are on the same property title and at least one is occupied. As long as someone is living somewhere on a property, the vacancy levy would not apply, even if certain buildings on that property remain empty.

How would the council identify vacant homes?

Most vacant homes are easily identified through a combination of:

- Proactive inspections in neighbourhoods or buildings where census data shows high numbers of vacant homes

- Reports from other residents

- Flagging non-owner-occupier homes that have negligible water usage for further investigation

- Comparing Residential Tenancy Authority bond lodgement records with council data and asking investment property owners who don’t have a lease registered with the RTA to supply either a current tenancy agreement or proof that a non-rent-paying occupant is currently using the home

- Proactive disclosure by investment property owners, who would face even steeper fines if they are caught hiding the fact that their property is empty

In practice, not every empty home will be identified. But the goal of this initiative is to send a clear signal to investors that it is cheaper and less risky for them to sell their property, or lower their asking rent to find a tenant, than to leave it empty.

How is ‘vacant land’ defined?

Council’s current definition of ‘Vacant Urban Land’ is specified in its ‘Land Use Code Definitions.’ Land Use Code 1 defines Vacant Urban land as:

“Land upon which no structure is erected and which is being put to no higher use, or land upon which is being constructed an approved single unit dwelling until completion.

Excluding:

- land during the construction of a building/s or structure/s (excluding approved single unit dwellings)

- Land meeting the criteria of code 72

- vacant or disused building/s”

The definition excludes rural land which is ordinarily used for grazing or food production (including land which is temporarily left fallow or ungrazed while the soil/vegetation regenerates).

Is this blatant revenue-raising? How would you spend the money you collect?

Raising more revenue from the small proportion of property investors who leave properties empty means less revenue needs to be raised from ordinary ratepayers.

Any money raised by the vacancy levy would be allocated towards the acquisition, construction and maintenance of crisis accommodation for survivors of domestic violence. However in practice, we anticipate relatively little revenue would be collected via this vacancy levy, as most investors will choose to avoid the levy by selling their property or finding a tenant. The primary goal is to change investors’ behaviour, rather than to raise money.

Does applying the vacancy levy to commercial properties unfairly punish investors at a time when demand for CBD office space and certain kinds of retail properties has collapsed due to the work-from-home shift?

No. There is always latent demand for commercial tenancies, particularly from new businesses, non-profit organisations, community groups, and artists and event organisers. The problem is simply that commercial landlords are refusing to drop their rents to meet the market, because they worry that accepting lower rents will affect the assessed value of their property portfolio.

If commercial landlords are willing to reduce their rents far enough, they’ll be able to find a tenant.

The added benefit of a vacancy levy on commercial properties is that developers will think more carefully before building an oversupply of new offices, retail shops and hospitality premises, and will instead focus on building residential homes.

If some investors simply cannot find tenants for certain kinds of commercial properties, this will create a strong incentive for them to convert these buildings into residential dwellings.

(1) Brisbane City Council Meeting Minutes, 2 May, 2023, page 64.

(2) There is 3.9 km2 of privately owned vacant urban land in the 11 Council Wards of Central, Coorparoo, Enoggera, Hamilton, Holland Park, Moorooka, Morningside, Paddington, Tennyson, The Gabba and Walter Taylor.